Electric Vehicle Battery Supply Chains: The Basics

An overview of electric vehicle battery materials, supply chains, key challenges, and current federal government actions.

Electric vehicles continue to increase in popularity due to growing consumer awareness, many compelling new models coming to market, and several jurisdictions now taking action to reduce pollution and address climate change. Sales are taking off in major markets like Europe, China and here in the U.S., with growth likely continuing in the coming decades. With this increasing demand for electric vehicles comes increasing demand for batteries. We must act now to build out sustainable battery supply chains and ensure they limit environmental and human health harms.

Luckily, the United States has begun to take steps towards addressing some battery supply chain challenges, but more prioritization and funding is needed to ensure we can have access to the minerals needed to accelerate transportation electrification, without jeopardizing the health of the environment and communities that often bear the brunt of contamination and climate change impacts. So, what are these challenges, and how are decision makers thinking about solutions?

Transition minerals and battery supply chains

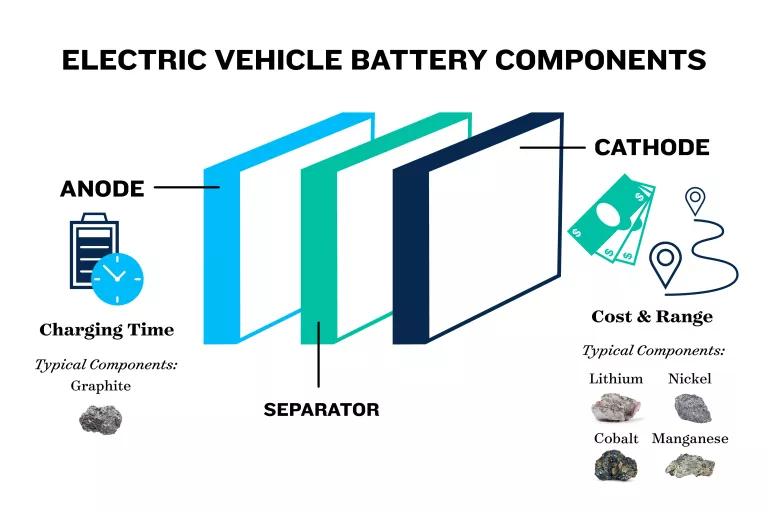

Many challenges with battery supply chains are tied to extracting and processing of five minerals used in many of today’s leading electric vehicle (EV) batteries: lithium, nickel, cobalt, manganese, and graphite. These chemical elements form the basic building blocks of lithium-ion battery cells and are what gives them the power to store and release energy for propelling electric vehicles. Due to the growing importance of EVs and batteries to the U.S. economy, the Department of Interior has included these elements on its list of “critical minerals” in recent years indicating concerns about securing future supply. These five battery minerals, a handful of other critical minerals, and a few rare earth elements and other non-critical minerals like copper make up the “transition minerals” that we need for a zero-emission vehicle (ZEV) economy. Mineral needs for electric vehicle batteries will significantly drive overall market demand for transition minerals over the coming decades.

Electric Vehicle Battery Components

Infographic by Jessica Russo: https://www.jessicaannarusso.com/ Source Image by Volkswagen: https://www.volkswagenag.com/presence/investorrelation/publications/presentations/2021/03/2021-03-15_PowerDayVWGroup.pdf

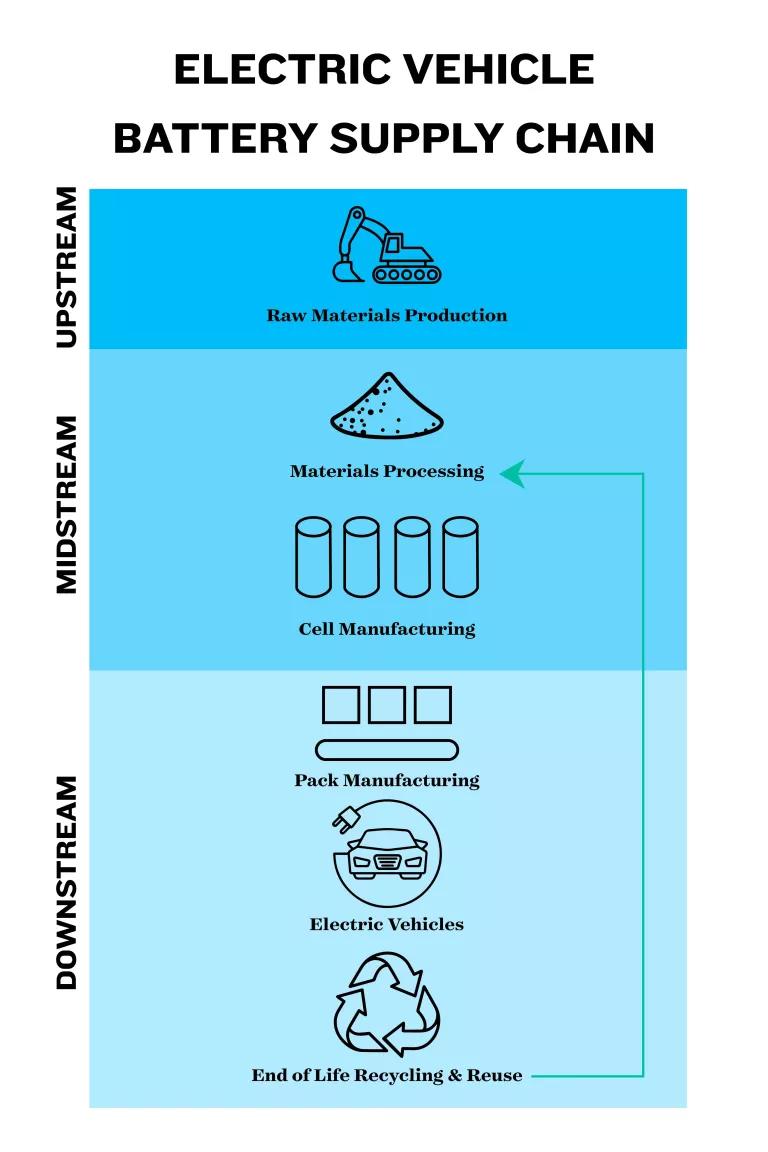

The battery supply chain is composed of many actors who work to transform raw mineral building blocks into the sophisticated devices we use daily to power our electric vehicles, smartphones, and laptops. The mining industry is responsible for the upstream portion of battery supply chains including identifying and exploring mineral reserves and extracting ores – sediments mixed with valuable minerals – from these resources. These ores are then transported to a facility where they are processed to remove extraneous materials and refined to a quality suitable for batteries. Once refined, one manufacturer uses these materials to make cathodes and anodes – the “positive” and “negative” side of the battery respectively – and sends them to downstream facilities that makes battery cells. Finally, the battery cells are sent to yet another manufacturing facility where they are combined into large packs that can then be used in electric vehicles. At the end of the downstream portion of this supply chain, batteries are hopefully reused or recycled so that their materials can be recovered and used in new batteries.

Electric Vehicle Battery Supply Chain Phases

Infographic by Jessica Russo: https://www.jessicaannarusso.com/ Source Image by the U.S. Department of Energy: https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

Supply challenges

This supply chain is quite complex, and challenges pop up throughout each step. Let’s start at the beginning with upstream extraction and refining activities.

Low domestic supply of EV battery minerals and recycled materials for battery manufacturing is a common concern. Transition mineral reserves are highly concentrated outside of the United States; 50% of global lithium and cobalt reserves are in Chile and the Democratic Republic of Congo (DRC) respectively. Geographic concentration of mineral reserves is a matter of nature, not need, but concentration issues extend beyond mineral reserves to other phases of the battery supply chain. Midstream supply chain activities, like mineral refining and battery cell manufacturing, are also concentrated in a small number of countries, largely outside the U.S. So, even if the U.S. mined the mineral resources it does have, they would currently need to be shipped to other countries for processing. Plus, between long discovery and exploration periods, low-quality data from industry, and lack of federal agency resources, over a decade can pass before minerals are extracted from a reserve in the United States. As a result of all this geographic concentration, mineral and battery supplies could become a major source of geopolitical risk or even conflict.

Shifting extraction to the U.S. could potentially reduce these geopolitical risks and be an improvement in safety standards and health protections for workers compared to many countries. However, the combination of insufficient National Environmental Policy Act, or NEPA, processes and outdated mining laws in the U.S. prioritize extraction over other land-uses, monitor water use and contamination poorly and without independent parties, and do not require stringent enough mining waste and tailings management or provide sufficient information about potential impacts to communities. As a result, the metals mining industry is the largest single source of toxic waste in the United States. Native communities likely disproportionately bear the brunt of these regulation gaps as 97% of nickel, 89% of copper, 79% of lithium, and 68% of cobalt reserves in the U.S. lie within 35 miles of Native American reservations. Securing metals must not come at a sacrifice to the environment and free prior and informed consent for Indigenous communities.

Congressional and executive supply chain engagement

The federal government is working to understand these domestic supply challenges through congressional hearings, and alleviate them though President Biden’s Presidential Determination invoking the Defense Production Act to secure domestic critical minerals supply chains as well as $7 billion total in grant funding to support domestic battery supply chains from the Bipartisan Infrastructure Law. Further, the Department of Interior launched a joint agency collaboration to improve mining and land use regulations, and the Clean Energy Minerals Reform Act has been introduced in Congress in both the House and the Senate to reform the Mining Law of 1872 which the U.S. is still operating under 150 years later. It is imperative that these Federal actions and any subsidized activities implement strong cultural, environmental, and due diligence standards and encourage adoption of less impactful and wasteful extraction methods like Direct Lithium Extraction and mineral recovery from waste treatment.

Material substitution and technological improvements

Demand for transition minerals is rapidly growing, and supply chains are struggling to keep up. Pressure to meet growing demand combined with geopolitical, resource location, and environmental protection issues make meeting supply needs sustainably particularly challenging. Alleviating supply concerns must focus on reducing reliance on new extraction as a tool for addressing these challenges. Material substitution and technological improvements are key factors in reducing demand for minerals; improved battery chemistries can provide the same amount of energy storage with much less mineral inputs or with different minerals that are more abundant and less impactful. Advanced manufacturing processes can reduce inputs needed by improving material efficiencies during battery production.

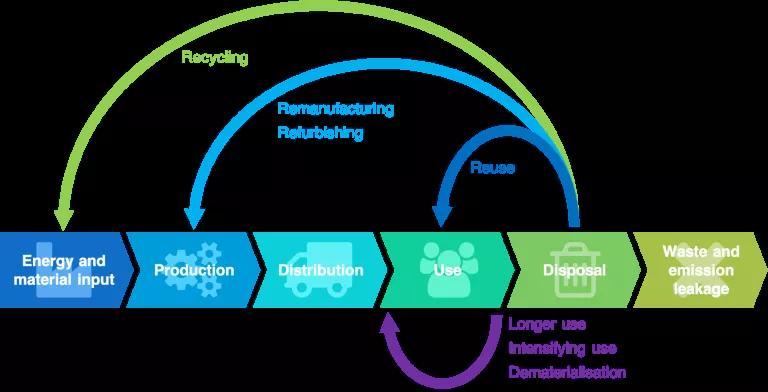

Reduce, reuse, and recycle

Additionally, reusing and recycling old batteries can reduce the need for newly mined materials—also known as a circular economy. However, the lack of labeling requirements, scale of collection and processing infrastructure, recycled material content minimums, and nuanced waste regulation all contribute to a series of barriers to a circular economy for electric vehicle batteries. Unfortunately, today most lithium-ion battery recycling currently recovers minerals at much lower rates than technologically feasible, and often less than 1% of lithium is recovered. But there are some success stories. Redwood Materials partners with auto manufacturers like Tesla, Ford, and Volvo to ensure material recovery rates above 90% at their electric vehicle battery recycling facility in Nevada. RePurpose Energy has licensed technology and piloted commercial scale energy storage projects that repurpose old electric vehicle batteries for microgrids. Finally, efforts to reduce our reliance on passenger vehicles by investing in better public transport and alternate forms of mobility can also help reduce pressure on battery demand to some degree over the longer term.

Circular Economy Conceptual Diagram

Martin Geissdoerfer: DOI:10.1016/j.jclepro.2020.123741

Reducing demand and limiting impacts

We need to continue to push for a net-zero economy in order to avoid the worst impacts of the climate crisis and protect the communities that bear the brunt of these impacts. Electric vehicles are a major piece of this puzzle. The transition to zero-emission transportation can avoid repeating the mistakes of the fossil fuel era by prioritizing demand reduction, recycling, and reusing materials. When mining must be done, this need should be carefully balanced with community impacts, Indigenous rights, and environmental concerns. We must support policies and programs that ensure the supply chains for electric vehicles and their batteries are secure, circular, and limit harm on the planet and the people we strive to protect.