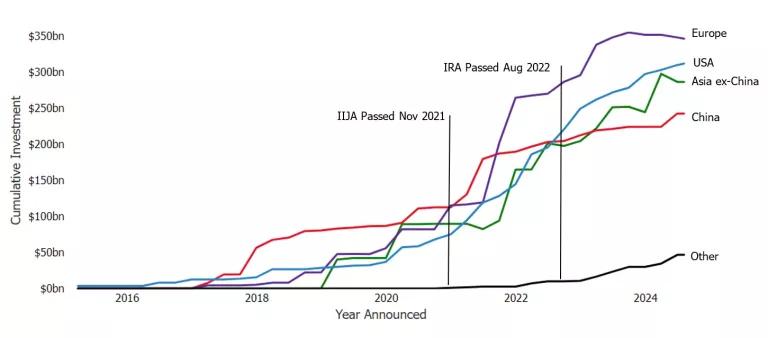

U.S. Is Now a Global Leader in Attracting EV Investments

Since President Biden took office, investments in electric vehicle and battery manufacturing in the United States have skyrocketed to $312 billion, more than any other country.

Total investment commitments by EV and EV battery manufacturers, by region

Atlas Public Policy

The United States is the top nation for attracting investments in electric vehicle (EV) and battery manufacturing, surpassing announced investments in China and other countries globally. Companies have announced $312 billion in planned investments in the United States, up from about $75 billion when President Joe Biden took office in 2021, according to an NRDC-commissioned report and dashboard by researchers at Atlas Public Policy.

Of the $312 billion of planned investments targeted for the United States, $223 billion has been allocated to specific facilities or initiatives; this is up nearly $66 billion since January 2023, demonstrating that companies are turning their earlier commitments into on-the-ground investments. More than half of that investment—$133 billion—is slated for battery manufacturing and recycling; 32 percent, or about $70 billion, is allocated for EV manufacturing; and $21 billion is directed toward facilities producing components further down the supply chain, such as EV parts and critical minerals.

After years in which China dominated EV manufacturing, the latest data is showing a dramatic turnabout: The United States took the lead over China to be the top destination for these investments in 2022, just as the Inflation Reduction Act (IRA) became law.

In fact, the United States is now attracting nearly a quarter of all announced global EV investments. Prior research by Atlas and BlueGreen Alliance showed that there are now 484 active or planned facilities across 40 states with Georgia, Michigan, Nevada, North Carolina, and Tennessee being the top states benefiting from EV investment.

.pngfc0e.jpg)

Jessica Russo

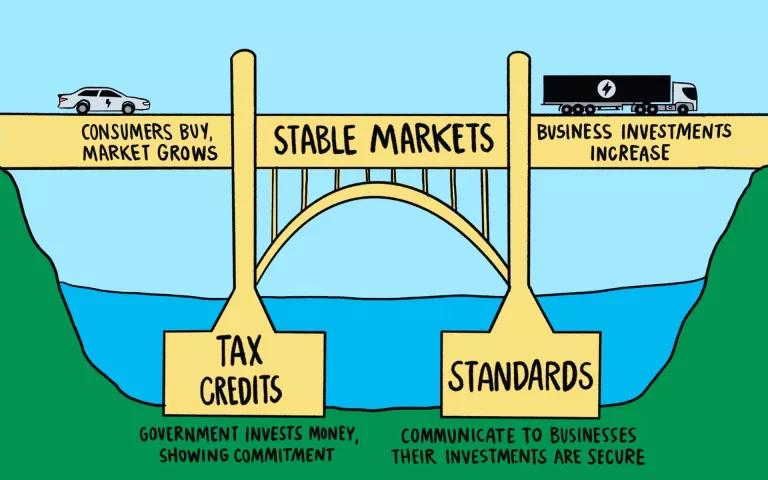

Federal tax credits, grants, and policies are driving private investment

The tremendous growth in industry investments has largely been credited to the Inflation Reduction Act, which passed Congress and was signed into law by President Biden two years ago. It provides favorable tax credits for manufacturing and consumer incentives. Together with strong national clean vehicle standards from the U.S. Environmental Protection Agency (EPA), this is resulting in automakers investing in cleaner, more efficient technologies, such as battery electric vehicles and hybrids. Of the total investment allocated to specific EV facilities or initiatives ($223 billion), nearly half has been announced since the IRA was signed into law. The EPA’s announcement of final federal vehicle emissions standards in March of this year provided further certainty to global investors.

Plus, consumer tax credits have been supporting a steadily growing market. The Internal Revenue Service announced $1 billion in uptake between the Clean Vehicle Tax Credit (Section 30D), which provides up to $7,500 tax credit for new EVs, and the Used Clean Vehicle Credit (Section 25E), which provides up to $4,000 for a qualifying used EV. Since the beginning of this year, 125,000 consumers have purchased new EVs and 25,000 have purchased used EVs.

Tax credits and standards support stable markets with more investment and consumer uptake

Jessica Russo

These private investments have also been boosted by programs under the Inflation Reduction Act, including the $1.7 billion announced last month by President Biden to help retrofit factories to manufacture up to 11 million electric vehicles annually. These announcements mark a significant global shift, as the commercialization and production of lithium-ion batteries over the past three decades have been dominated first by Japan and then by China. It is a homecoming of sorts, as U.S.-based researchers in the 1970s and ’80s helped to invent and develop lithium-ion battery technology; one researcher received the Nobel Prize in Chemistry in 2019 for his contributions, alongside others.

Locking down announced investments

Ensuring these announced investments result in actual domestic projects—and don’t get shifted to other countries—will require long-term regulatory certainty through the upholding of clean car and clean truck standards, together with successful implementation of the investments under the Bipartisan Infrastructure Law, the Inflation Reduction Act, and state programs. Unfortunately, the oil industry lobby, including the American Fuel & Petrochemical Manufacturers, is spewing misinformation to try and roll back the policies helping the transition to new, fossil-free technologies to keep American consumers and their pocketbooks hooked on oil.

The good news is that states and counties across the country are seeing real investments being made, boosting the local economies and creating good jobs. Most state and federal officials know that the smart move is to bet on the future, not the past.

What we need now is regulatory stability so that companies can feel confident in investments and continue to implement current commitments, which will ensure that the United States can be a global leader in the EV transition and attract new investments and jobs. And there is a historic opportunity for the United States to build batteries better by making these new supply chains circular and more sustainable through domestic investments in recycling, reusing, and reducing waste.

Almost overnight, the United States is poised to become a global leader in innovative, cleaner, and cost-effective electric vehicle manufacturing. Record investments in a cleaner future can help boost the economy, create jobs in communities across the country, and provide a cleaner and more affordable way of moving people and goods. Let’s get to work!