2022: Hydrogen Beta Testing Must Ensure Climate-Alignment

Here is a snapshot of the key federal efforts that we’ll be closely following over the next year.

Credit: iStock

Part of NRDC’s Year-End Series Reviewing 2021 Climate & Clean Energy Developments

This year was a turning point for hydrogen, with ambitious global commitments and the forceful entry of the U.S. into the international hydrogen arena. Only a year ago was the U.S. still considered a sleeping giant in the hydrogen game. But it has now jumped to the top rungs of countries supporting the advancement of hydrogen with the Department of Energy’s (DOE) Hydrogen Shot initiative—one of the most ambitious efforts to slash the costs of clean hydrogen production—as well as a slew of subsidies and supportive policies for hydrogen deployment in the federal bipartisan infrastructure bill and the Build Back Better Act (BBB).

The initial global hydrogen hype has now faded, and the debate has become more nuanced. Attention is now oriented towards policies and regulations that would govern hydrogen production, transport, and use to ensure that the technology’s deployment is aligned with the goal of ensuring that global temperature increase does not exceed 1.5C. Zero-emissions green hydrogen could play a pivotal role in supporting the deep decarbonization of the U.S. and world economy. However, ill-conceived agendas risk steering it away from this potential and turning it into a climate problem (more on this here). Those risks have prompted an independent expert group to launch the Hydrogen Science Coalition—a global body that aims to bring “concrete evidence back into the hydrogen debate, free from industry bias".

Separately, the global hydrogen principles, which NRDC co-authored with the UN High-Level Champions, set a frame of reference of the safeguards necessary to ensure a climate-aligned hydrogen deployment.

2021 was marked by the U.S. commitment to expand the role of hydrogen in its economy; 2022 should be the year where the federal and state governments implement rigorous policies and regulations to ensure that hydrogen deployment is climate-aligned and safeguards the transition to a net-zero economy by midcentury. Below is a snapshot of the key federal efforts that we’ll be closely following over the next year.

On the big hydrogen chess board, the DOE has the first decisive move

DOE will play a pivotal role in the hydrogen market formation as the infrastructure law and Build Back Better legislation place a slew of key initiatives within the department’s purview.

1. Lifecycle emissions accounting of hydrogen production: DOE may soon be prescribing a methodology for determining the lifecycle emissions of hydrogen production pathways. Rigorous accounting of lifecycle emissions is the foundational step to shaping a hydrogen market consistent with the climate imperative. Major lifecycle emissions categories include methane leakage linked to gas extraction and delivery in blue hydrogen production and the carbon intensity of the electricity feeding the electrolyzer in the electrolytic hydrogen pathway. There is now ample evidence that loose accounting and emissions measurement rules linked to hydrogen production could result in serious climate risks. Studies estimate that absent robust methane leakage regulations, blue hydrogen could be worse than burning fossil fuels due to the potency of methane as a greenhouse gas. Similarly, electrolytic hydrogen powered by average U.S. grid electricity in lieu of verifiably renewable electricity can be twice as carbon intensive as today’s incumbent gas-based hydrogen. In fact, debate is roiling in Europe around the necessary policies to ensure that the power feeding electrolyzers is renewably sourced and that the addition of electrolyzers on the electric grid does not inadvertently increase emissions. We’ll be closely engaged in this important international debate.

It is paramount for DOE to prescribe a rigorous framework for evaluating the lifecycle emissions of hydrogen production pathways and couple it with robust measurement, verification and reporting structures for major emitting categories like methane leakage and the electricity feeding electrolyzers.

2. A “clean” hydrogen threshold: DOE will also be prescribing a carbon intensity threshold to define “clean” hydrogen sources that would be eligible for policy support. An ambitious carbon intensity threshold is fundamental to creating a hydrogen market oriented towards the cleanest sources. Considering that hydrogen assets tend to be long-lived, a weak initial standard carries lock-in risks into ill-conceived investments that may complicate the task of decarbonizing our economy. Devising a robust and feasible carbon intensity standard for hydrogen production is a major global topic of debate. The European Commission has proposed a standard of 73.4% reduction in greenhouse gas emissions relative to today’s gas-based hydrogen, with a strong push that includes industry voices to further tighten it. A global initiative is contemplating to adopt an even more ambitious harmonized global standard.

The DOE should prescribe a world-leading carbon intensity threshold to signal the hydrogen market towards sources with the highest climate and public health standards and solidly position the domestic hydrogen industry for international trade. The department has informally articulated a potential target threshold of 80% greenhouse gas reduction below today’s gas-based production. This would be an appropriate starting point that DOE should consider strengthening concurrent with technological advancement.

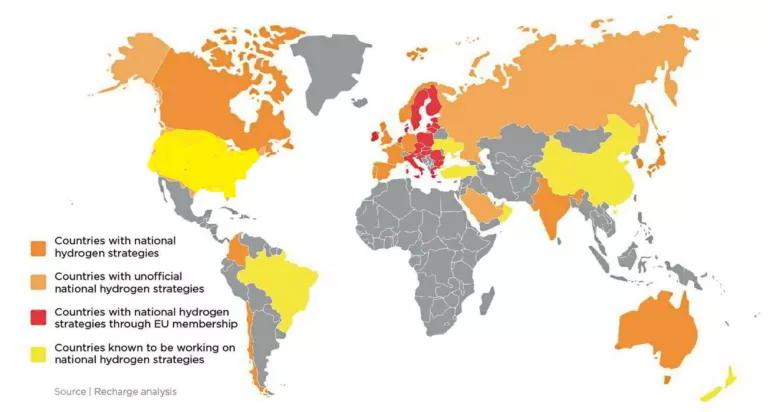

3. U.S. Hydrogen Roadmap: DOE was also directed to publish a national hydrogen strategy and roadmap by May 2022. Once complete, the U.S. would join the growing list of major economies that log a national hydrogen strategy. The roadmap aims to catalyze and lift barriers to the widespread deployment of hydrogen in the U.S. economy. It is poised to confer that long-term market signal that investors look for and give them visibility on how and where to invest. This is a big deal and will have strong bearing on how the hydrogen market will shape.

Source: Recharge News, "Hydrogen now firmly at the heart of the global race to net zero — for better or worse"; With NRDC’s yellow coloring of the U.S. to reflect the DOE’s work on the hydrogen roadmap pursuant to the federal infrastructure law.

The DOE should:

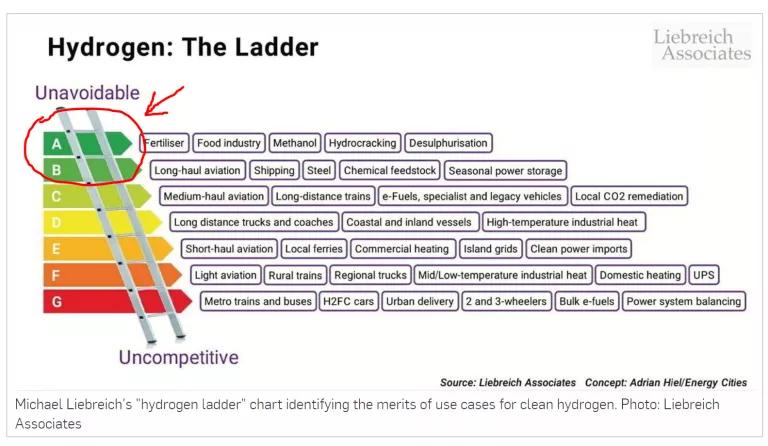

- Identify and advance the use cases that hydrogen is best suited to decarbonize. There is now incontestable evidence that those will likely be sectors with no other viable decarbonization paths – like steelmaking, maritime shipping and aviation. The Department should focus on advancing those applications. In contrast, hydrogen is woefully inefficient and an expensive solution for applications like building heating or fueling passenger cars. The DOE should provide an honest account of hydrogen’s most promising- and more narrow- market potential to guide investments accordingly. This would go a long way in dampening the voices of proponents in the oil and gas industry pushing for ill-conceived and expansive hydrogen deployment agendas.

- Target existing hydrogen users as a no-regret way to scale up green hydrogen production. Refineries and fertilizer producers consume substantial quantities of polluting gas-based hydrogen. We estimate that requiring or incentivizing those users to replace only a quarter of their hydrogen use with green hydrogen by 2030 could drive the deployment of roughly 32 gigawatts (GW) of electrolyzers. This is not too far from the global 45 GW target estimated to drive dramatic cost reductions in green hydrogen production. The DOE should leverage this enormous and no-regrets opportunity to scale up the industry by outlining feasible targets and policy mechanisms to nudge existing hydrogen users in this direction. The European Commission, India and Spain- among others- have either proposed or are contemplating ambitious green hydrogen targets by 2030 for existing hydrogen users.

- Focus on hydrogen sources that are most aligned with climate and public health goals. Zero-emissions, green hydrogen has primacy over other sources in terms of climate and public health integrity and should be prioritized by the Department. For example, the German national strategy favors green hydrogen as the resource most aligned with long-term climate goals.

DOE should target the applications that hydrogen is best suited to decarbonize, given an A or B grade on the Liebreich ladder.

4. The Four Hubs: The infrastructure legislation directs DOE to fund at least four hydrogen hubs across the U.S. This intends to kick-start the U.S. low- carbon hydrogen market by advancing the production, transport and use of low-carbon hydrogen. The initiative has spurred a national buzz as states and industry actors vie for a spot among the four.

In doing this, DOE should be guided by the hydrogen roadmap to:

- Prioritize the deployment of zero-emitting, green hydrogen (even if the statute requires some deployment of fossil-based hydrogen);

- Target existing hydrogen users like refineries and fertilizer plants to scale the production of low and zero-carbon hydrogen in the most no-regret manner.

- Prioritize the advancement of hydrogen use in applications that may not have other viable decarbonization solutions like maritime shipping, steelmaking, aviation, and long-duration electricity storage. In efficient pathways to net-zero, those will likely be the largest sources of hydrogen demand in 2030 onwards. Yet, they require robust RD&D in this decade to commercialize in time.

No room for trial and error: we must press for rigor and ambition from the start

The way in which we kick-start the hydrogen market will have a lasting impact on our efforts to decarbonize the U.S. and global economy. We have the opportunity to cement hydrogen’s status as a climate solution and steer it away from becoming a major foe in the climate fight. With the climate alarm bells tolling, failure is not an option.

.jpg3a0c.jpg)