Why the Keystone XL Tar Sands Pipeline Matters for Climate

Following the close of the thirty day public comment period, the National Interest Determination (NID) process will continue as federal agencies consider over 2 million comments concluding that the Keystone XL tar sands pipeline is not the nation’s interest. At the same time, the environmental community submitted its own comments regarding the project, in which NRDC included an in-depth analysis of Keystone XL’s critical role in enabling high cost tar sands expansion projects to move forward. NRDC’s assessment comes shortly after a report released the former head of research for Deutsch Bank finding that many tar sands projects will not be economic without Keystone XL, analysis by the Pembina Institute, a Canadian think tank, concluded that Keystone XL would enable greater tar sands expansion, and a Reuters investigation showed that tar sands shipments to the Gulf by rail have fallen far short of predictions, knocking more holes in the argument that rail can substitute for Keystone XL.

Experts throughout the Administration will have a chance to review the mounting evidence that a tar sands industry with Keystone XL will be larger and more carbon intensive than one without it and reach their own conclusions. As they do, they will consider how the approval of Keystone XL will undermine U.S. climate leadership and its credibility in negotiating strong international climate commitments. Moreover, they will consider how the approval of Keystone XL will undercut Canada’s ability to honor its existing climate obligations as well as reducing its capacity make future emissions reductions. An objective consideration will show that the Keystone XL pipeline is a long term commitment to infrastructure which would enable and lock in the expansion of tar sands production and the associated climate emissions and as such, is not in the nation’s interest.

The role that the proposed Keystone XL tar sands pipeline plays in enabling tar sands expansion continues to be central in answering whether the project fails the President’s climate test. Keystone XL’s Final Supplemental Environmental Impact Statement (FSEIS) acknowledged that the tar sands transported by the pipeline are more carbon intensive than the conventional crude it would replace and that Keystone XL offers the cheapest transport option for tar sands producers.

However a close evaluation of the report’s assumptions reveals the State Department likely underestimated the extent to which Keystone XL would facilitate the expansion of the tar sands and associated carbon emissions. The FSEIS provides decision makers with a sufficient basis to find that Keystone XL fails the test President Obama laid out last year—that the pipeline must not significantly exacerbate carbon emissions. The key findings that lead to rejection of Keystone XL in the FSEIS on climate grounds include:

- Tar sands crude is significantly more carbon intensive than conventional crude.[1]

- Tar sands crude from Keystone XL is most likely to displace the lightest, least carbon intensive crudes from the global market.[2]

- Certain market conditions (described in Section 5) prevent some tar sands projects from moving forward without Keystone XL. Under these conditions, Keystone XL would lead to 27.4 million metric tons of additional CO2 emissions per year, a figure greater than the tailpipe emissions generated by 5.7 million vehicles over a year. For the project’s estimated fifty year lifespan, that adds up to 1.4 billion metric tons of additional carbon emissions.[3]

- According to the Administration’s social cost of carbon estimates, Keystone XL’s additional emissions would generate up to $128 billion in climate related costs.[4]

Despite these findings, the FSEIS does make several critical mistakes in its market analysis which leads it to underestimate Keystone XL’s role in expanding tar sands production. As you’ll see, the environmental review makes a number of unreasonable assumptions and in many cases, ignores its own analysis to craft its conclusion that Keystone XL is unlikely to impact tar sands expansion.

Environmental review assumes global failure to address climate change

While the FSEIS did find significant climate impacts from the pipeline, the market analysis relies on energy consumption scenarios which assumes a global failure to address climate change. The FSEIS uses models which are all predicated on a “business as usual” energy consumption patterns through 2035 leading to a catastrophic 6 degree Celsius increase in global temperatures. This is significant because the assumption that our global economic will continue to lead us toward catastrophic levels of climate change for the next quarter century assumes substantially greater demand for crude oil and higher oil prices that feed a tar sands industry unfettered by carbon taxes.

By contrast, International Energy Agency (IEA) models of energy consumption necessary to limit climate change to 2 degree of warming forecast reduced oil consumption and significantly lower oil prices through 2035 than the scenarios the FSEIS used. Even in a less ambitious and more dangerous scenario where nations only honor the climate commitments they’ve already made, IEA shows lower demand leads to a $30 decrease in oil prices. Should international efforts to address climate change strengthen at all from current levels—a goal the United States is committed to—tar sands expansion will be significantly more dependent on cheap pipeline infrastructure than in this high carbon, high oil prices scenarios used in the FSEIS.

Figure 1. Comparing carbon emission assumptions in EIA scenarios assuming high global oil consumption used in the FSEIS with models targetting a stable target (chart by Barry Saxifrage).

Moreover, a highly visible failure by the United States to consider either the “450 scenario” or the “New Policy scenario” as plausible options when evaluating energy infrastructure decisions will undermine the nation’s credibility as it negotiates global efforts to achieve those climate safe scenarios. If the State Department approves Keystone XL based on analysis assuming a complete failure to enact policies addressing carbon emissions over the next quarter century, it will hamstring U.S. credibility moving into the 2015 climate talks. As Secretary Kerry should know, the world is watching.

However, even after assuming global failure to stabilize the climate lead to higher oil consumption and prices, the FSEIS made several unreasonable assumptions that allowed it to craft conclusions based on a scenario in which Keystone XL’s climate impact will only be felt if oil prices lower. In many cases, these conclusions ignored critical analysis in the environmental review itself and presents for a distorted forecast of future expansion—particularly given that tar sands expansion projects are already being delayed by a lack of pipelines. If corrected, any one of these assumptions would force a dramatic shift in the FSEIS conclusions. Taken together, they lead to a conclusion that Keystone XL is the critical linchpin for a carbon intensive industry that’s on the ropes.

Let’s examine each in turn.

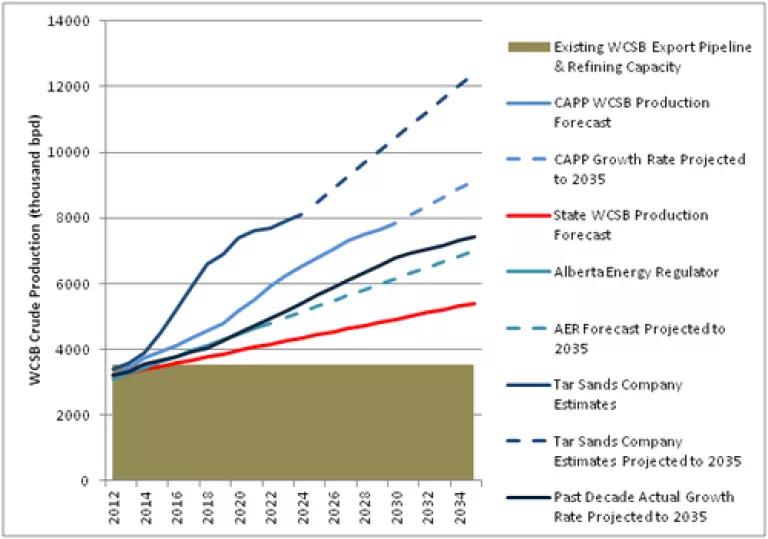

The FSEIS assumes that even if industry gets high oil prices and all the proposed pipelines it wants, growth will be a fraction forecast by industry or seen over the last decade. The FSEIS assumed that Western Canadian production would only increase by 2.2 million bpd by 2035—half the growth rate seen over the last decade and a third of that forecast by the tar sands industry (Figure 2). It’s also lower than the expansion rates projected by the Energy Information Administration (EIA), the IEA, Canada’s National Energy Board (NEB) and the Alberta Energy Regulator (AER). By assuming such a “slow tar sands expansion” the FSEIS makes it more likely that alternatives could fill the gap if Keystone XL is not approved and therefore significantly underestimates Keystone XL’s impact on tar sands expansion.

Figure 2. Comparison of tar sands production growth estimates. The FSEIS’s reference scenario for tar sands expansion underestimates Keystone XL’s impact on tar sands expansion assuming higher growth projections.

The FSEIS eliminates from its analysis nearly 2 million bpd of high cost tar sands projects of new tar sands mines—most of which have already been approved by the Canadian government. The assessment assumes that over 2 million bpd of proposed tar sands mines are economically infeasible regardless of whether Keystone XL or other tar sands pipelines are built. There is a high likelihood approved mining projects will be developed if pipelines like Keystone XL are approved. But by excluding these higher cost projects—many of which already have government approval—it eliminates the projects most likely to be affected by Keystone XL’s rejection.

The FSEIS assumes that higher cost tar sands mines will be prevented from moving forward relying on its arbitrarily low production forecast rather than by their economic feasibility. This is not a rational assumption, particularly in an industry in which there are numerous companies competing. Rather, it is the expected price of oil that will dictate entry. As noted by Canadian economist Andrew Leach:

“If you want to know what the break-even price for new oil sands projects is (at least for the marginal project), look at the forecast of future oil prices. The break-even price will always be at or near this level as long as open access to the resource is allowed – it’s basic economics.”

It’s worth observing that the financial analysts at Carbon Tracker reached a similar conclusion, which used the FSEIS’s own analytical framework to show that the report excluded about 2 million bpd of proposed projects that would not be economically feasible without Keystone XL.

While the FSEIS recognizes that Keystone XL’s rejection will result in lower tar sands prices as supplies grow in Western Canada and the Midwest, it does not consider the impact of those lower prices on tar sands expansion. One of the biggest factors currently affecting the profitability of tar sands expansion is that a lack of transport capacity is leading to a glut of heavy crude oil, lowering prices. The FSEIS recognizes this dynamic, stating that in a “pipeline constrained” scenario where Keystone XL is rejected, tar sands crude would sell at a larger discount relative to global oil prices. This discount—approximately $15 a barrel greater—would directly impact the profitability and feasibility of new tar sands production projects. However, the FSEIS doesn’t that discount in its assessment of Keystone XL’s impact on tar sands expansion. According to a recent analysis by the Pembina, had the FSEIS factored its lower price estimates into its conclusion, it would have found Keystone XL would affect tar sands expansion at prices below $100 per barrel.

The FSEIS wrongly assumes lower oil prices are unlikely. The FSEIS assumes higher oil prices which would make tar sands project more profitable and more likely use more expensive transportation options like rail. Alternatively, lower oil prices would put even the cheapest tar sands expansion projects in jeopardy. The evidence suggests lower oil prices are more likely. Both the futures markets at the Chicago Mercantile Exchange and the International Energy Agency (IEA) predict the oil prices will decline sufficiently by 2020 to realize the FSEIS’s ‘low oil price’ scenario. Moreover, the adoption of climate policies necessary to stabilize global warming would drive crude oil prices down even further.

The FSEIS overestimates the capacity of rail to serve as an alternative for Keystone XL. A critical question surrounding the Keystone XL debate is whether rail can serve as a low cost substitute for the massive tar sands pipeline. The FSEIS has now recognized that transporting tar sands by rail is likely to be more expensive than transporting tar sands by pipeline. However the FSEIS underestimated the relative costs, logistical obstacles and regulatory complications associated with expanded tar sands by rail.

Moreover, recent government data shows that tar sands by rail to the Gulf Coast is just a fraction of that estimated by the previous environmental review. An investigation by Reuters found that Canadian crude shipments by rail to the Gulf were a fifth of what the draft SEIS forecast. In fact, despite a 30% increase in Canadian crude imports to the U.S. since 2010 and the tar sands industry’s desperate need to access the Gulf refinery market, Canadian crude shipments to the Gulf have actually declines by 18%. So much for Ambassador Doer’s assertion that it’s a choice between rail or pipeline. It’s not—it’s a choice between investing in a clean energy future or one based on bottom of the barrel tar sands.

In addition, the FSEIS failed to account for recent common sense safeguards to enhance the safety of crude by rail. In fact, recent measures adopted by the rail industry have already caused North Dakota producers to take their product off the rail and put it into pipelines. If rail is a less attractive option for producers of light crude, it will certainly become even less feasible for tar sands producers, who haven’t had the same success with it to begin with.

In direct conflict with the FSEIS conclusions, current tar sands pipeline bottlenecks are already constraining investment in tar sands expansion. The FSEIS’s conclusions, based on the flawed assumptions above, suggest that rejection of Keystone XL would only constrain tar sands expansion when oil prices fall below $85 a barrel.[5]However, current pipeline constraints have already effected capital spending on tar sands expansion and resulted in the suspension of new mining projects despite current oil prices in excess of $100 per barrel. Capital spending in the tar sands industry has declined precipitously, declining in 2013 to little more than half spending levels in 2012. Meanwhile, Shell’s 100,000 bpd Pierre River mine was recently suspended, as well as the Aurora Hill’s expansion proposals. This illustrates the reality that tar sands expansion is already being constrained by a lack of pipelines at oil prices well above the FSEIS’s low oil price scenario.

Tar sands producers themselves recognize that they will not realize their expansion plans without new pipelines. Recently CEO of major tar sands producer Cenovus told reporters that his company’s plan to triple production in coming years was contingent on more pipeline capacity. Meanwhile financial giants, including RBC Capital, Goldman Sachs, Barclays and CIBC, have all publicly acknowledged that a tar sands industry without new pipelines will be smaller than one with them.

As the National Interest Determination continues, Administration officials considering the mounting evidence that Keystone XL is a linchpin for tar sands expansion will reach their own conclusions and decide whether a pipeline likely to increase carbon emissions by 27.4 million metric tons is in the national interest. Secretary Kerry recognizes that climate change poses a threat as urgent as “terrorism, epidemics, poverty and the proliferation of weapons of mass destruction” and that each major infrastructure decision we make dictates whether our country slides down the path of business as usual policies leading to climate catastrophe.

[1]State Department, Supplement Final Environmental Impact Statement (SFEIS), Section Jan. 31, 2014, 4.14.30-31.

[2]The FSEIS recognizes that in the short to medium term, light crude balance world oil supplies – meaning that whichever crude is offset from the Gulf Coast market, tar sands from Keystone XL would offset lighter, less carbon intensive crudes. State, SFEIS, 4.14.25.

[3]State, SFEIS, 4.14.41.

[4]In 2007 dollars, the social cost of Keystone XL’s incremental 1.4 billion metric ton carbon impact is between $80.6 billion and $114 billion using the administration’s SCC figures as a discount rate of 2.5% to 3%. Adjusting to 2014 dollars, that figure rises to between $90 billion to $128 billion. Interagency Working Group on Social Cost of Carbon, U.S. Government, Technical Support Document: Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order 12866 (May, 2013) (all dollar amounts in 2007$); Bureau of Labor Statistics, Inflation Calculator, Accessed February 28, 2014, http://www.bls.gov/data/inflation_calculator.htm).

[5]State Department, Final Supplemental Impact Statement (FSEIS), Market Analysis, 1.4-125, Jan. 31, 2014.