Time to Plan for Phasing Out Funding for Overseas Gas

According to the IEA’s Net Zero Emissions scenario, unabated gas-fired generation must start to decline in the late-2020s. Governments, multilateral and private financial institutions must step up to phase out financing, especially for overseas gas.

LNG Tanker

All global plans for building LNG export terminals, overseas natural gas fired power generation and individual country energy transition proposals must be realigned to drive meaningful climate action. According to the IEA’s Net Zero Emissions scenario, unabated gas-fired generation should start to decline in the late-2020s. The declarations at the Glasgow Climate Summit provided an important signal to shift away from gas as a bridging fuel and towards 100% renewables. More countries, multilateral and private financial institutions should join this effort and help drive energy sector investments towards a 1.5°C aligned pathway.

In addition to the Nationally Determined Contributions (NDC) submissions, many countries further enhanced their commitments by aligning with various initiatives. Several important partnerships were forged to accelerate the global energy transition of moving away from coal, oil, and gas infrastructure.

The traditional belief that gas will serve as transition fuel over the coming decades is a key challenge to meeting global climate obligations. Our analysis shows that for example using LNG to replace other, dirtier fossil fuels, is not an effective strategy to reduce climate-warming emissions. In fact, if the LNG export industry expands as projected, it is likely to make it nearly impossible to stay below the 1.5°C threshold for avoiding catastrophic climate impacts.

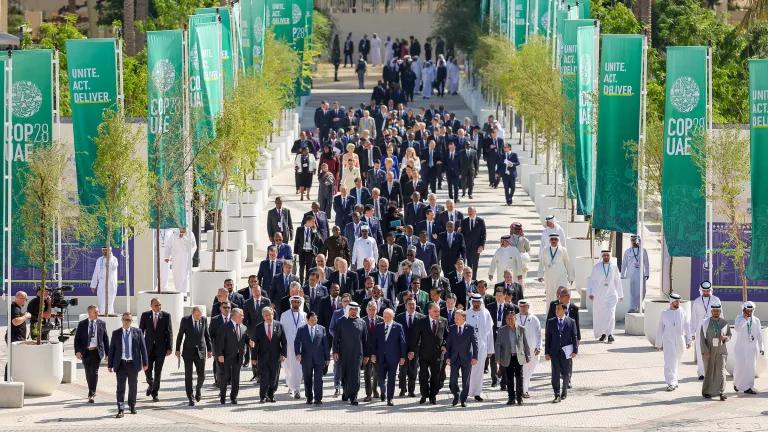

The Glasgow Climate Summit witnessed important new commitments to end overseas oil and gas financing, begin a managed transition away from oil and gas production, and providing technical and financial support to speed up the renewables buildout. They are a welcome step towards scaling up climate ambition. This includes the Beyond Oil and Gas Alliance, the Global Energy Alliance for People and Planet, the International Public Support for Clean Energy Transition announcement and the US Net Zero World Initiative (see Table 1).

The initiatives are:

- Statement on International Public Support for the Clean Energy Transition includes 34 countries and 5 financial institutions committing to “end new direct public support for the international unabated fossil fuel energy sector by the end of 2022, except in limited and clearly defined circumstances that are consistent with a 1.5°C warming limit and the goals of the Paris Agreement”.

- Beyond Oil and Gas Alliance (BOGA) launched with 11 national and subnational governments joining as initial leaders committing to “facilitate the managed phase-out of oil and gas production".

- Global Energy Alliance for People & Planet is a new partnership with an initial $10 billion in funding from philanthropies and development banks to support energy access and the clean energy transition.

- Net-Zero World Initiative is a new partnership between countries working to implement their climate ambition pledges and accelerate transitions to net zero, resilient, and inclusive energy systems, led by the U.S. Department of Energy.

Rapid Shifts in Public & Private Sector Finance Is Key to Delivering

A key priority for these initiatives should be to reduce the availability of public and private sources of finance, especially for new build fossil fuel projects including overseas gas. From 2017-2019, gas projects received an average of $16 billion in international public finance per year—four times as much as for wind or solar energy across the global south (see figure 1). International public finance from the MDBs and G20 bilateral financial institutions such as bilateral development banks and export credit agencies is underpinning this growth.

Private financial institutions are overwhelmingly driving investments in overseas oil and gas. Between 2016 and 2020 the world’s 60 largest banks provided almost $3.8 trillion in fossil fuel financing. This unrestricted access to finance for the oil and gas sectors needs to be addressed.

A handful of governments, public and private sector institutions are the biggest contributors to oil and gas financing. They can help drive the political, regulatory and market shifts necessary for accelerating the global clean energy transition away from all fossil fuels (see Table 2).

U.S. Can Lead on Shifting from Overseas Oil & Gas Finance

The momentum achieved at Glasgow through these alliances including those announced by the US Government could cumulatively provide significant climate benefits. To deliver on pledges made at Glasgow, the U.S. should:

- End U.S. financing of overseas gas by issuing detailed guidance pursuant to the Biden Executive Order and Climate Finance Plan which called for Agencies to “end international official financing for carbon-intensive fossil fuel based energy”,

- Steer the Multilateral Development Banks financing away from gas by effectively implementing the new Treasury Department guidance and voting against projects,

- Focus on being a leader across the global clean energy growth opportunity,

- Issue guidance by the Federal Reserve Board to the US Banking industry encouraging a phase out from overseas fossil fuel energy projects pushing back on the belief that gas is a transition fuel.

Other Countries & Investors Need to Step-Up to End Oil & Gas Finance

While 34 key countries and 5 financial institutions have committed to end public fossil fuel finance by the end of 2022, more countries, public financial institutions, and private finance need to join this effort. Many of the major public financial institutions, key countries (i.e., China, Japan, Russia, Saudi Arabia, South Korea) and the MDBs (e.g., the World Bank Group, European Bank for Reconstruction and Development, and the Asian Development Bank) have yet to join the emerging coalition seeking to end financing of all overseas oil and gas projects. All of the major financial institutions continue to support fossil fuels, despite several of them committing to a long-term net zero target (see table 3).

More Work Ahead on Fossil Fuel Finance

Collectively the Glasgow sectoral initiatives support the necessary range of actions to keep 1.5°C alive. However, for these pledges to be fully implemented, decision-makers will have to take a ‘whole-of-government’ approach to deliver on all their climate targets, initiatives, and pledges. Countries and financial institutions can help deliver a climate safe future by ending financing of fossil fuels and shifting scarce resources towards renewable energy. They need to do that right now to make sure that this decisive decade delivers.