Going Under: Post-Flood Buyouts Take Years to Complete

NRDC's new report finds that more than 5 years elapse between a flood and the completion of most FEMA-funded buyout projects.

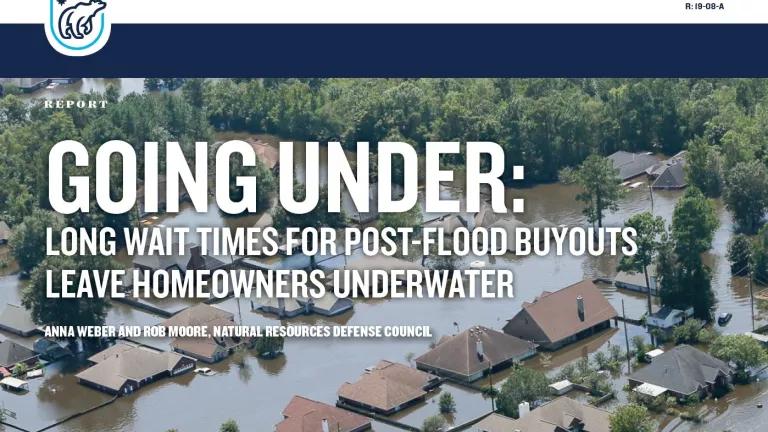

Enabling people at risk to move out of harm’s way must be an essential component of the nation’s climate adaption strategy, but a new NRDC report shows how current practices are not capable of rising to the challenge. Our report, Going Under: Long Wait Times for Post-Flood Buyouts Leave Homeowners Underwater, finds that more than 5 years elapse between a flood and the completion of most FEMA-funded buyout projects.

Five years can feel like an eternity to residents of repeatedly flooded neighborhoods. Access to options that reduce risk is more important than ever, as millions of Americans may be displaced by flooding and sea level rise in the coming decades. Many will need assistance to move to higher ground—but current funding programs for voluntary buyouts already struggle to meet existing demand, with years-long wait times that make assistance difficult to access and contribute to inequities in disaster recovery.

Since the 1980s, the Federal Emergency Management Agency (FEMA) has funded over 43,000 buyouts, in which local or state governments purchase flood-damaged properties from willing sellers at pre-flood values and preserve the land as open space. But once a property is included in a request for FEMA funding, homeowners can be kept in limbo for years, waiting to find out if their homes will or won’t be purchased. In the meantime, the home may flood—and be rebuilt—yet again.

This inefficient process further burdens the indebted National Flood Insurance Program (NFIP) and exacerbates stress for flood survivors. Flood survivor John Knipper of Charleston, SC described his experience like this in a 2017 NPR interview:

Maybe five years from now, John, we will give you the money for your house. But, you know, we don't know when. So why keep me in that [expletive] place thinking that I'm going to be bought out in three months and the three months and the three months and the three months keeps getting extended. And that's what's really aggravating people.

Most important, many of the homeowners suffering through these long waits are those who can least afford it. Earlier research by NRDC found that the most flood-prone homes in the nation are likely to be owned by lower-income residents. In many cities, the legacy of redlining—denying access to credit based on the racial characteristics of a property’s location—means that low-income people and people of color are more likely to live in flood-prone neighborhoods. And lower-income residents are unlikely to be able to afford to wait for months or years to be offered a buyout, while their home may be uninhabitable and they continue to face the risk of flooding.

Our report describes approaches for improving the current system, as well as new buyout models that NRDC believes are worth exploring by FEMA, other federal agencies, and state and local governments:

- Investigate the reasons for delays in the current process and study how to make buyouts more timely and more accessible, with special attention to low-income homeowners. More work should be done to understand the obstacles in the current process and how they can be addressed. Future work should also include consideration of the interconnected social, cultural, economic, and equity issues related to buyouts and how these are influenced by current and proposed processes.

- Make direct assistance for buyouts available through the NFIP. Because flood insurance claims are generally settled within weeks of a flood, rather than the months or years needed for mitigation grant funding, this approach would allow buyouts to happen within a time frame that makes more sense for homeowners.

- Pre-approve and guarantee buyouts as a benefit of flood insurance coverage for people whose homes have flooded multiple times. NRDC has developed a mechanism that would guarantee eligible homeowners a buyout if their home is substantially damaged in a future flood disaster. As part of their flood insurance coverage through the NFIP, interested participants would be guaranteed future assistance to relocate in exchange for discounted flood insurance premiums.

- Leverage the capacity of nonprofit organizations to facilitate buyouts, similar to the role they play in acquiring land for conservation. Land trusts and other nonprofit organizations often work with government agencies to quickly acquire land for conservation purposes. Allowing local governments to purchase land initially acquired by conservation groups would expedite the process for homeowners while allowing localities to access traditional sources of buyout funding.

We must acknowledge that climate change is already affecting our lives and our communities and adapt accordingly. While every buyout project is different, one thing is clear: long wait times make buyouts less accessible, less equitable, and less effective for disaster mitigation and climate adaptation. Addressing this issue is essential to making FEMA-funded buyouts a more viable option as climate change increases flooding throughout the United States.